What is STP Phase 2

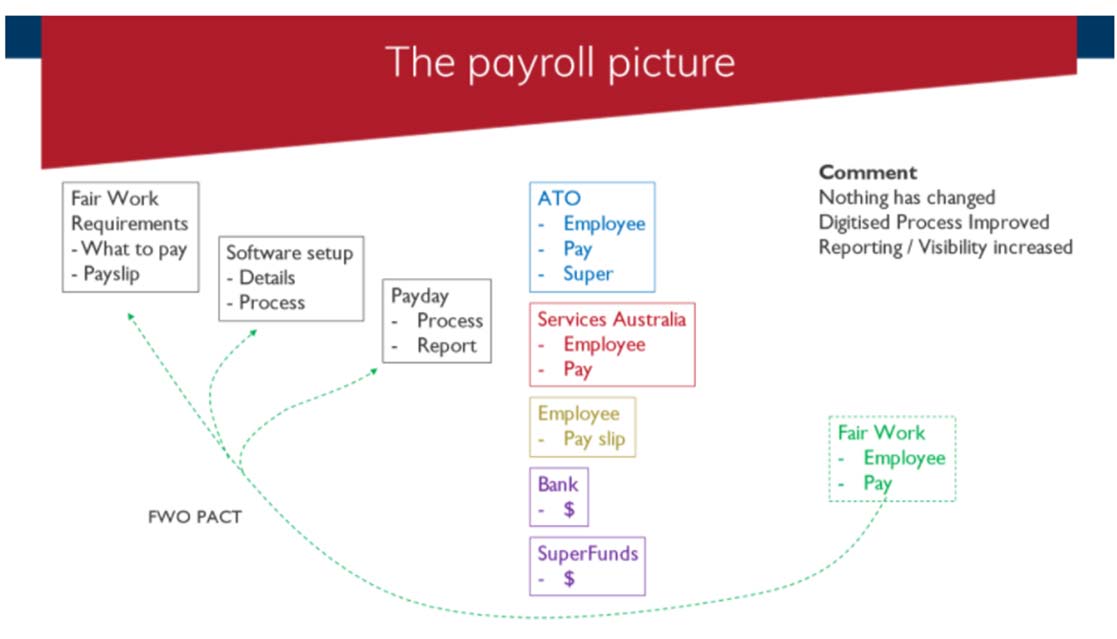

STP 2 is all about extra data being made available to government. Many of these things’ employers are doing already but now the requirement will be to report it each pay event.

STP2 is the digitalization, automation and streamlining of a compliant payroll system.

See below a breakdown of software information:

Intuit/QBO are definitely ready to go from the 1st of January 2022 and will not be seeking any deferrals. Source: Intuit – Single Touch Payroll (STP) Phase 2 FAQ

MYOB are confirmed for 1st January 2022.

Source: MYOB Business – Getting ready for STP Phase 2

GovReports are ready now.

Source: GovReports Upgrade – Single Touch Payroll Phase 2

Reckon –Have secured a 12-month deferral for all customers and partners to start STP Phase 2 reporting from 1st January 2023.

Source: Reckon –STP Phase 2: Update for Reckon users

Xero partners and customers will be covered by a deferral until 31st December 2022 – so there’s no need for concern around the January deadline. Source: Xero Blog – Single Touch Payroll Phase 2 is coming: Here’s what Xero users need to know

What are the key changes?

- Disaggregation of gross

- Employment and taxation conditions

- Income types

- Country codes

- Child support garnishees and Child support deductions

- Reporting previous Business Management Software IDs and Payroll IDs

Benefits of STP Phase 2

Benefits for employers

You’ll no longer have to send us your employees’ TFN declarations. Your employees will provide it to you, and you’ll need to keep it with your employee records.

We’ll make it easier for employees at tax time as we’ll have better visibility of the types of income they’ve received and where it should be pre-filled on their individual income tax return.

Over time, the new information reported will allow us to tell employees if they’ve provided you with incorrect information that may lead to them getting a tax bill. For example, where an employee hasn’t notified you that they have a Study and Training Support Loan.